| MandevillePowell River |

The Principles That Guide Our Investment Decisions

We try to look at investments with an objective eye. We know that you want to lower your taxes, manage your risk and of course the cost to your bottom line matters. These principles guide our investment recommendation process.

The Mandeville Difference

We know that good investments are the "table stakes" of our world. We also know the world’s wealthiest families create true lasting wealth by investing in a mix of both public and private investments. That is the Mandeville Difference. Our goal is to democratize these private investment opportunities for wealth creation, and where appropriate, provide our clients with the same investment techniques used by ultra high net worth and institutional investors.

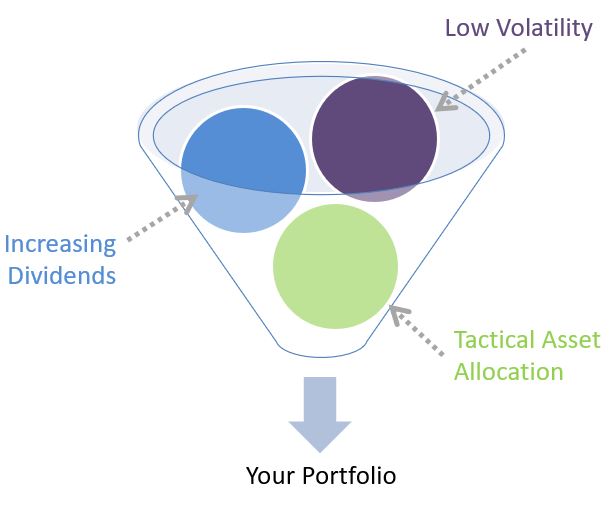

How We Manage MoneyEvery client situation is unique, but since our primary focus is pension style investing our research focuses on three areas. We love to find investments that offer: Increasing Dividends

Low Volatility

Tactical Opportunities

|