| MandevillePowell River |

What We Do

Listening and responding to our customers is a critical part of everything we do – we're here to make your life easier! Our customer respect also extends to our sales process – or rather, lack of it. We believe our products and support speaks for itself... no hard sell, we promise.

|

|

|

For You: Comprehensive Financial PlanningEach of our clients can expect a written plan that will help them to understand their retirement, insurance, tax and estate needs. A good Financial Plan allows you to be proactive to life's events and it is essential to keep you on course.Retirement PlanningIn retirement one of the most satisfying things you can achieve is a reliable income, with a minimum of tax. Proper planning can help ensure your retirement income is there for you over your entire lifetime and that the tax burden is spread out efficiently.Estate PlanningA good estate plan will often go beyond our wills, we will work with you and your other professionals to get what you need in place. We try to make sure you will be comfortable with how and when your personal and business assets will be passed to your family. Of course minimizing the taxes that result is always a priority and if some of your heirs will need additional guidance we can help you to take steps to protect and guide them. In some cases charitable giving and trusts are a significant part of your plan. Insurance PlanningInsurance, used with foresight, can provide unique opportunities for tax planning, charitable giving and estate management. We make sure that you will understand what tools are available for you to use as part of your plan. Tax PlanningOften tax planning must be done years in advance to be effective, but if we can offer you a way to reduce or deffer taxes we will. For many of us estate taxes are the easiest to manage and it can make a huge difference to your family. Of course you must also make use of every other advantage like TFSA accounts, prescribed annuities and income splitting, if appropriate for you. For Your Investments: A Consistent and Continuous ProcessOur goal is to create a personalized investment portfolio to assist you with navigating the volatility of today’s markets. We co-ordinate the specialists, knowledge and resources you need to manage your wealth. Our process is designed to assist you to invest with institutional style discipline, considering your individual investment management requirements, and fulfill the day-to-day monitoring of your portfolio. In short, we try to make it as easy as possible to make the right decisions for you and your family.

|

Custom Planning

| Personal Advice

|

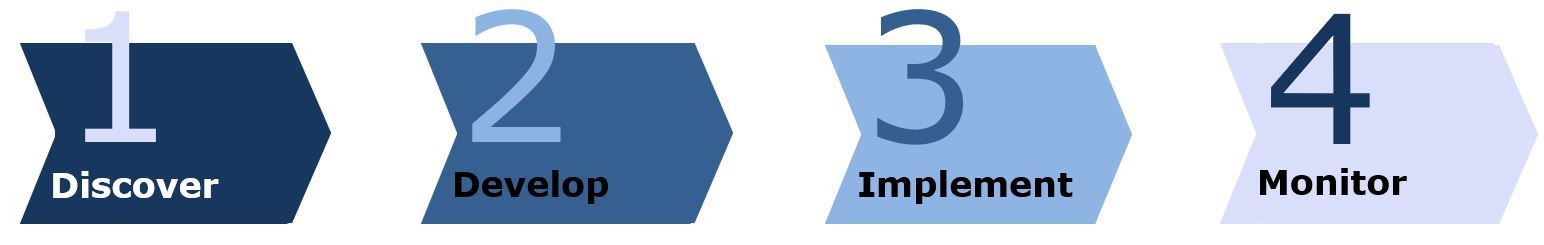

Our Process

|

|

|

|